CrowdProperty is a marketplace lender that solves the pain points of borrowers and investors on either side of the finance equation in the small-scale property development sector.

On the one hand, we give retail investors access to the types of high-quality loan investment opportunities in the property market that have long been the exclusive preserve of institutions and high-net-worth individuals.

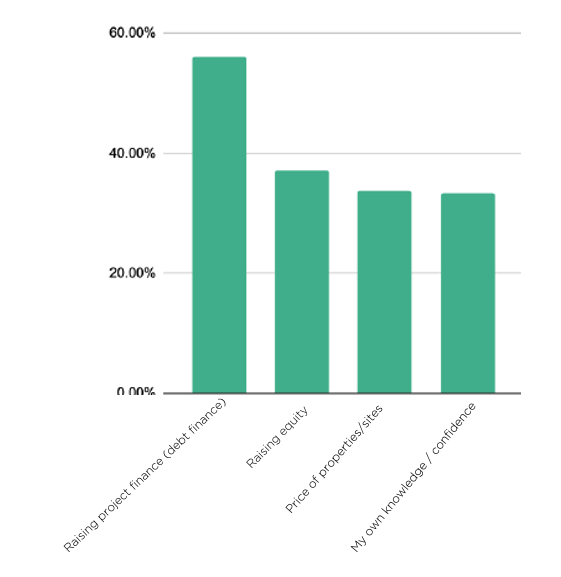

On the other side of the equation, we solve the financing pain point of small-scale property developers so they can build more homes. According to our recent small-scale developer survey, the number one issue preventing small-scale developers from building more homes in Australia is access to debt finance.

CrowdProperty solves this pain point by using a custom marketplace platform that efficiently matches the demand for finance with diverse sources of capital, whether it be from retail, wholesale, or institutional investors.

The platform makes private debt investments in project loans accessible to retail investors, by enabling them to allocate comparatively modest sums of funding to projects they can select from our platform.

Our team of property specialists assesses every loan application against a rigorous due diligence process to ensure only the highest quality projects make it onto the marketplace platform.

CrowdProperty brings benefits to all parties — we create wealth opportunities for retail investors and funding opportunities for small-scale developers. This can help Australia overcome a severe housing shortage by providing funding for those smaller, in-fill development opportunities often overlooked by traditional lenders

What is CrowdProperty’s track record?

CrowdProperty Australia is modelled on CrowdProperty UK (which is also a shareholder in the Australian company). CrowdProperty UK has amassed a remarkable track record in the decade since its founding in 2013.

The UK company has provided around $560 million in funding for the construction of over 3,000 homes worth more than $1.25 billion (as at July 2023).

CrowdProperty Australia was launched in May 2021, and in just two years has achieved some major milestones. These include attracting over $570 million in small loan applications and making $16 million in funding facilities available.

Both CrowdProperty UK and CrowdProperty Australia have a 100% record of returning total capital and interest to lenders.

CrowdProperty UK has also just been included in the Sunday Times 100 (93rd) — the prestigious annual ranking of the most rapidly expanding private companies in Britain.

The growth of CrowdProperty

CrowdProperty Australia has raised equity to grow its business over the next two year period, to help more investors access high-quality property opportunities and more small-scale developers secure financing for their projects.

In 2023, we intend to expand our borrower team to unlock our pipeline, and increase our marketing to attract more retail, wholesale, and institutional investors. We will also invest in new products for affordable housing, specialist products like specialist disability accommodation (SDA), and modern methods of construction.

We’re using the latest technology to build the leading non-bank lender for small-scale developers.

We’ve already demonstrated that we can solve the pain points for small-scale developers in Australia, providing them with the funds needed to build more homes where people want to live.

Our team has also proven it can provide excellent financial opportunities to investors, with a 100 percent track record of return on both capital and interest.

Our long-term vision is to use our marketplace platform as one of the solutions to Australia’s affordable housing crisis, while enabling investors from all walks of life to grow their wealth.