Why Australian developers could soon hurdle over barriers to the missing middle

Back to Blog 26 August 2024 6 minute read

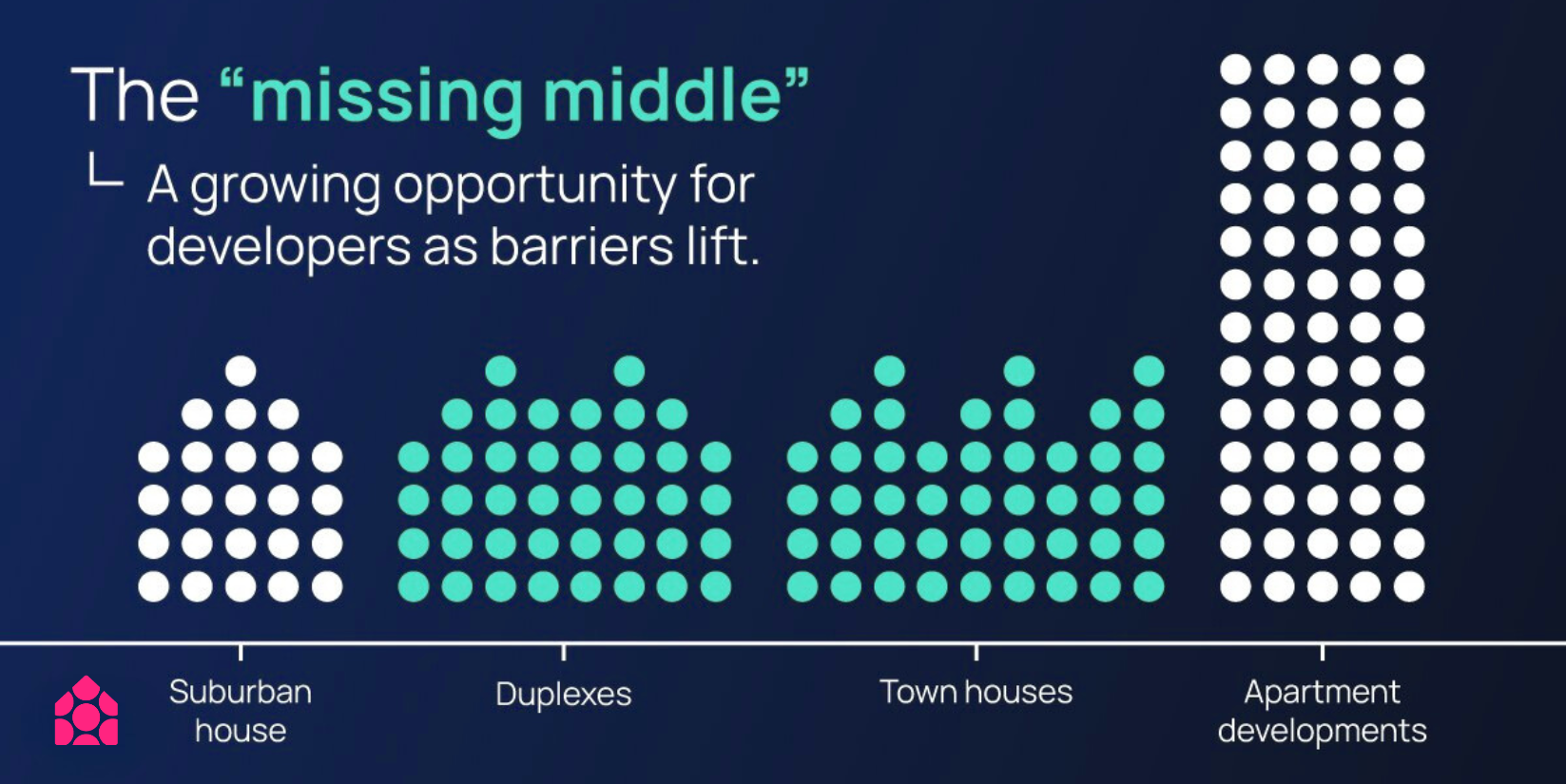

The “missing middle“ could solve many of the woes of the Australian housing market, by creating a diverse supply of medium-density homes that suit the needs of a fast-changing urban society.

In response to a worsening home affordability crisis, the Australian property sector is fast seeing the removal of long-standing barriers to missing middle homes, in a move that could shake-up nationwide housing supply.

This could create a raft of opportunities for small-scale developers ideally positioned to create medium-density housing in established suburbs.

What’s holding back missing middle development?

The “missing middle” simply refers to forms of housing that occupy the intermediate space between free-standing homes and high-rise apartments, and middle ring suburbs which are desirable for home buyers. These include small apartment blocks (commonly around six apartments), duplexes, townhouses and terrace housing.

While the diversity and moderate density of missing middle homes make them an outstanding fit for the Australian housing market, a slew of related factors have long prevented developers from storming this segment of the market.

Chief amongst them is NIMBYism (not in my backyard) and community hostility from existing homeowners towards the development of new, missing middle homes in their suburbs.

Established Australian homeowners can be very keen on keeping the character of neighbourhoods unchanged, which in turn influences the planning decisions of local authorities.

Local planning instruments in Australia also give established homeowners a highly effective means of thwarting missing middle development. Communities opposed to such developments can impede them via a range of planning mechanisms, including heritage and character protections.

These barriers are further exacerbated by highly complicated, at times even Byzantine planning approval processes, which serve as a major deterrent for stressed developers.

Even if local communities are supportive, remnant planning controls can continue to thwart missing middle development, given the difficulty of retrofitting these regulations without sufficient political will.

Another major factor impeding missing middle development is cost of funding, which impedes the feasibility of projects by undermining profits. This has been an especially acute issue of late due to the Reserve Bank of Australia’s protracted cycle of interest rate hikes.

Change is coming quickly

Despite these challenges, growth in missing middle home supply could be forthcoming as society rushes to respond to Australia’s worsening home affordability crisis.

Local governments around Australia have been mandated to drive missing middle growth in order to improve home affordability.

In May, Paul Scully, the NSW minister for planning and public spaces pointed specifically to the missing middle as a solution for the state’s housing challenges.

“Terraces, townhouses and smaller apartments have a significant role to play in creating housing options for families as we confront the housing crisis,” Scully said.

“Good examples of low and mid-rise housing are already part of Sydney’s past and can be part of Sydney’s future.”

In the same month, Canberra’s local government announced missing middle homes would be the future of housing in the nation’s capital.

ACT minister for planning, Chris Steel stressed the need to remedy the gap between high-density multi-unit homes and single-residential domiciles.

“This next stage of reform focuses on opportunities to supply a greater diversity of housing such as townhouses, row houses and duplexes on residential blocks,” Steel said.

The Victorian government has created an initiative to drive growth in missing middle housing around the state. In December last year, it launched new zoning regulations for the specific purpose of encouraging such development.

In March of this year, the Queensland government held a competition on missing middle home designs, with the goal of “[proposing] new housing options for Queensland that meet contemporary community, urban and environmental challenges.”

In addition to the removal of planning hurdles, missing middle development could also receive a boost from imminent reductions to the cost of funding. While rate cuts from the Reserve Bank of Australia have failed to arrive as early as previously expected, sooner or later the monetary authority will need to bring down its target rate in order to avert recessionary pressure.

Developers see opportunities in the missing middle

Small-to-medium-scale developers are well-positioned to capitalise on opportunities in the missing middle, given their adaptability and modest scale are better suited to these projects.

Rob Flux from Property Developer Network said developers seeing the upcoming opportunities in the missing middle are driving further recovery in the Australian housing market, despite the Reserve Bank of Australia (RBA) keeping interest rates on hold.

“The market itself has demonstrated that it’s starting to recover,” Flux said.

“We’re seeing listing volumes and sales volume up across the country.

“Property values are steadily climbing as well, with the exception of Melbourne and Hobart.”

Flux said developers should make haste to prepare for upcoming opportunities in missing middle development, given the inevitability of a rate cut from the RBA will further reinvigorate the market.

“Brand new developers who are still learning will want to improve their craft now before the market gets too hot, so they’ve actually got time to prepare,” Flux said.

“For anyone who ‘s a seasoned developer and has cash in the bank, now’s the time to be grabbing quality stock.”

CrowdProperty helps small-to-medium developers

As a specialised property platform, CrowdProperty is the ideal partner for empowering small-to-medium-scale developers to seize these new opportunities.

CrowdProperty focuses on providing financial access for small-to-medium developers that have long been neglected by banks and other traditional financial institutions.

Our team of property veterans also possess nearly a century’s worth of collective experience. We can provide critical advice to developers who want to help improve Australia’s home supply by pursuing missing middle projects.

As experts in the property sector, CrowdProperty can enable small-scale developers to access finance and overcome project headwinds. Click here to learn more.