2023 CrowdProperty small-scale developer survey report

Back to Resources 13 June 2025 13 minute read

A note from CrowdProperty Australia CEO, David Ingram

As property people providing finance to property professionals, we’re extremely proud of this unique survey which provides critical insights into the financing landscape for small-scale developers in Australia. We are certainly not aware of such an extensive survey of this cohort of people who are often hard to identify.

Read the summary of the survey below and complete the form to receive a copy of the full survey.

8 key results from CrowdProperty’s small-scale developer survey

Write up

About the survey

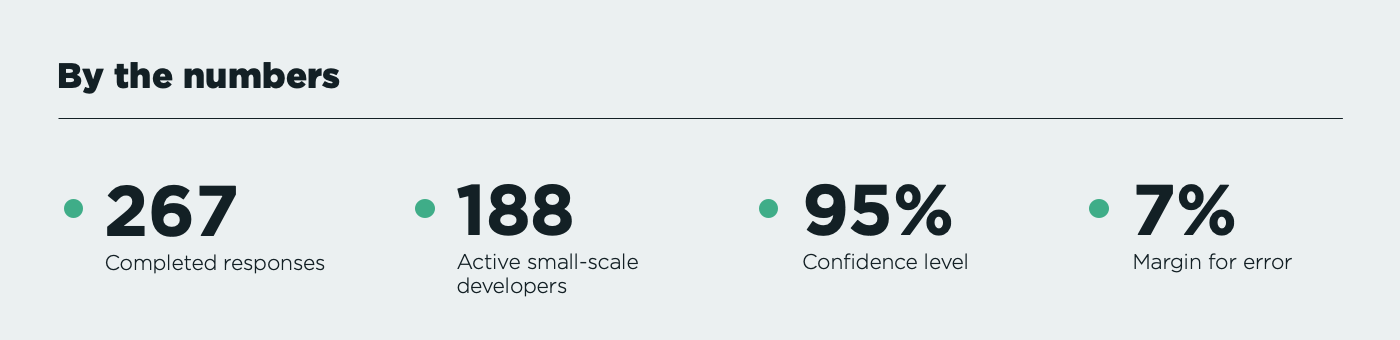

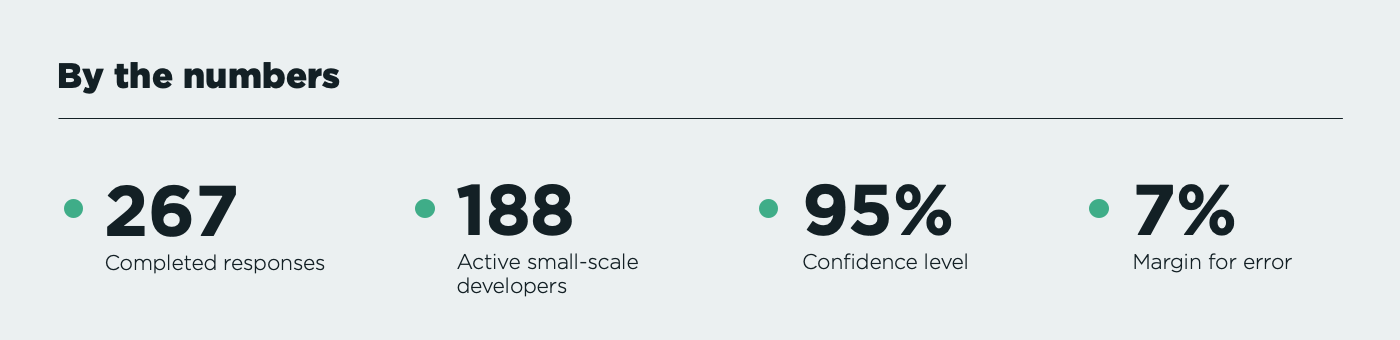

CrowdProperty conducted a ground breaking survey of Australia’s small-scale developers, seeking to better understand the pain points they face in today’s property market. [Feb 2023]

The survey saw CrowdProperty reach out to a range of development communities across Australia to learn more about their experiences and understanding of the real estate sector.

The questions covered a broad gamut of topics, including the ages and experience levels of respondents, as well as their preferred project types and scales. The survey also delved into the key pain points of developers, particularly with regard to the financing of their projects. Australia’s development communities responded positively to the survey, with nearly 400 participants providing CrowdProperty with detailed information on their challenges and pain points as developers.

The large volume of survey responses provides us with strong confidence in the statistical accuracy of the survey, and its ability to shed light on the real challenges of Australia’s small-scale developers.

1. The vast majority of developers are in the 35 – 64 year age group

The survey results indicate that Australians tend to wait until at least their mid-thirties before embarking in earnest on a career in property development.

2. Developers achieve success after a critical learning phase

As with any challenging trade, developers must first undergo a period of critical learning before acquiring the ability to succeed in the business. For this reason, the more accomplished developers tend to be those who have undergone a lengthy apprenticeship of studying the sector.

3. Developers with longer track records move on to bigger projects

As developers advance in their careers and the number of projects they’ve completed increases, so does the scale of their projects.

4. Developers focus heavily on residential new builds

Residential projects of various stripes remain far and away the most popular types of property undertakings for small-scale Australian developers.

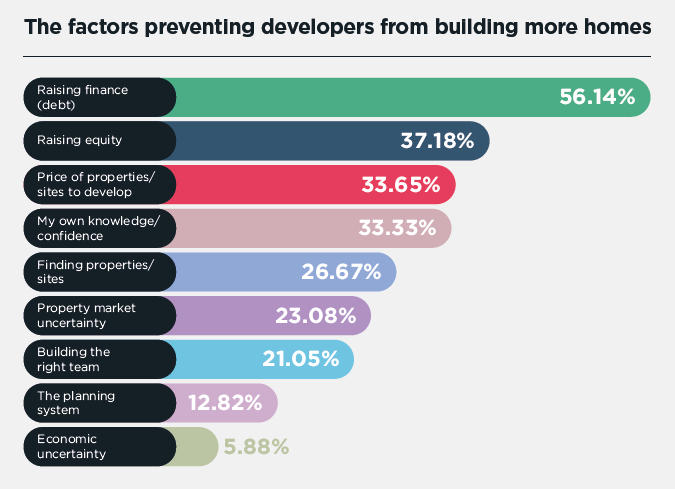

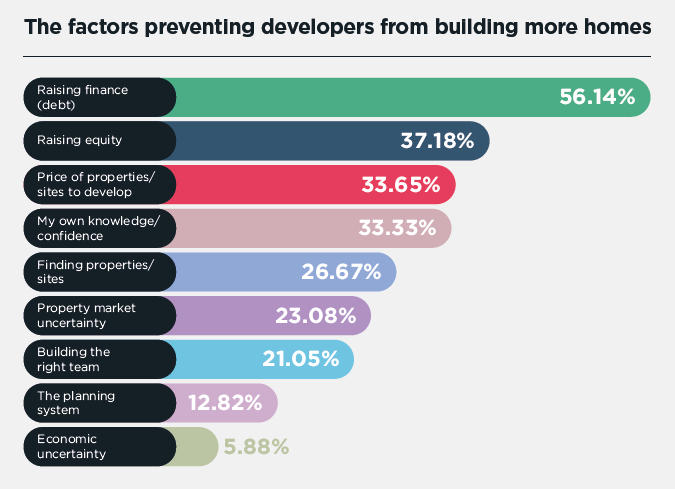

5. Debt financing is the single biggest barrier to building more homes

Given the cost of property development, debt financing is the biggest challenge for property developers when it comes to the completion of new projects.

6. Small-scale developers give traditional lenders negative NPS score

The survey results highlighted widespread dissatisfaction felt by small-scale property developers in Australia when it comes to the financial services provided by lenders.

7. Developers waste too much time trying to solve project finance

The survey results indicate that small-scale developers are unhappy with the amount of time it takes to secure project finance.

8. Developers are unaware of the hidden fees involved in financing

Small-scale developers remain surprisingly unaware of the hidden fees that can drive up the financing cost of their projects. This is largely due to lack of transparency on the part of traditional lenders, who still fail to cater to the needs of the development community.