What every SME developer should ask their finance broker about private lending

Back to Blog 21 August 2024 6 minute read

As traditional banks struggle to meet small-to-medium-scale (SME) developers’ needs, many are turning to private lenders. Over 45 percent of SME developers in Australia choose to only work with brokers to source finance. This article explores the key questions to ask your finance broker when sourcing development finance.

The Australian property development finance landscape is rapidly evolving, driven by the inability of traditional banks to meet the specific needs of small-to-medium-scale (SME) developers. This gap has created opportunities for specialised marketplace lenders who can deliver the speed, expertise, and certainty of finance that developers require.

Recent data supports this trend, with Citi estimating that local private credit (or non-bank financing) has surged by about 45 percent over the five years from July 2019, compared to just 25 percent growth in traditional bank credit.

For SME developers, this growth in private lending is particularly beneficial, as securing finance remains the greatest barrier to building more homes, according to 56.1 percent of respondents in CrowdProperty’s small-scale developer survey

Traditional banks’ lengthy and complex approval processes can delay projects and increase costs. In contrast, private lenders can provide tailored and scalable financing options that better suit the unique challenges of SME developers, including those working on niche projects like specialist disability accommodation and co-living construction.

Seven key questions for your broker

Australia’s property market faces numerous headwinds, including rising construction costs and labour shortages. By providing tailored, flexible financing options better-suited to small-to-medium developers’ unique challenges, private lenders can help projects move forward despite these conditions.

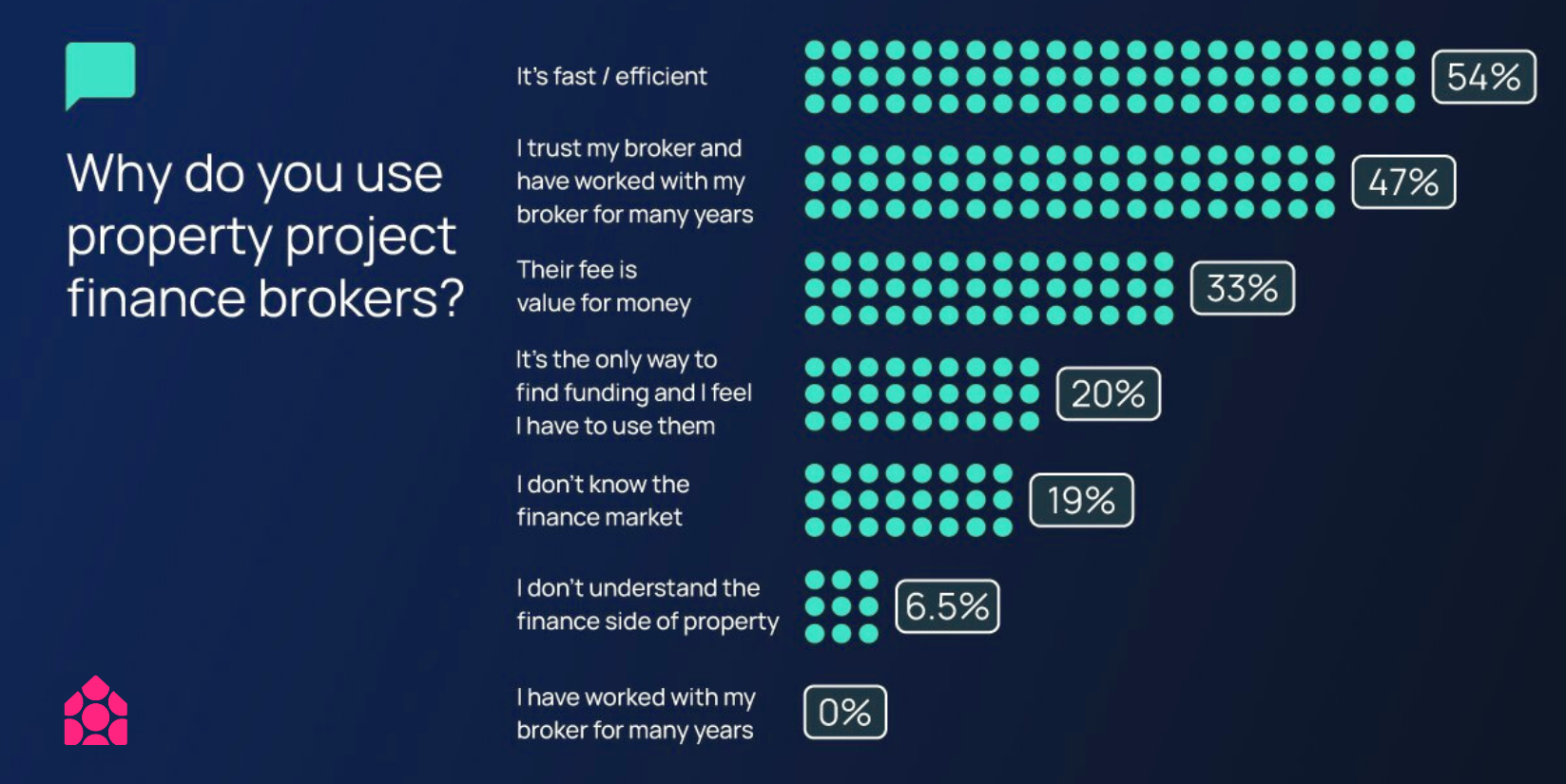

However, navigating the lending landscape can be complex – hence why 89 percent of SME developers surveyed by CrowdProperty rely on finance brokers – whether exclusively or in combination with direct lending options – when seeking project finance.

That leaves 11 percent who never use a broker, with the reasons given including:

- Lack of transparency (38.1 percent)

- Lack of property knowledge (14.3 percent)

- Belief they complicate the process (14.3 percent)

While having a knowledgeable broker by your side can help, it’s also important to pick your financial partners wisely.

Here are the questions you need to ask to help ensure you’re getting the right support from your broker.

1. What experience do you have with property development finance?

Your broker’s experience in handling complex property deals can significantly impact your project’s success. Ask for examples of similar projects they’ve financed and how they’ve managed specific challenges like construction delays or cost overruns.

2. Do you understand my needs?

Your project’s vision and challenges are unique. Ensure your broker comprehends the nuances, from zoning issues to cash flow constraints, and can provide tailored advice that aligns with your goals.

3. How transparent is your process?

Transparency in property finance is key. Working with a partner you trust can not only improve the chances of your project’s success, it also avoids the impact of any hidden service costs or fees. Ask your broker how they’ll handle disclosures, manage any conflicts of interest, and maintain open communication throughout the financing process. CrowdProperty, for instance, ensures developers have clear insight into every step of their financing journey.

4. What are the fees involved?

Development finance can have multiple layers of costs. Request a detailed breakdown of all fees, including broker commissions, legal fees and any other charges specific to your deal, so you can budget accurately.

5. Can the financing be tailored to my needs?

One of the main advantages of private lending is its flexibility. Unlike traditional bank loans, which often come with rigid terms, private loans can be tailored to fit your project’s specific needs. Ask your broker if they can secure financing that matches your development timeline, cash flow requirements and other project-specific factors.

6. How long will it take to secure financing?

Delays in funding can derail property projects, so speed is very important. That’s why, if you apply directly with CrowdProperty, you’ll get a formal offer typically within 72 hours.

7. Who will be managing my account?

Consistent, expert advice is vital throughout a property development project. Find out if you’ll have a dedicated expert managing your account, ensuring seamless communication and the ability to adapt strategies as your project evolves.

CrowdProperty: a direct-to-market lender that loves working with brokers

According to our survey, 45.2 percent of developers use brokers as their only funding route while 43.6 percent also apply directly to lenders.

Additionally, 57.1 percent of those who don’t use a broker prefer a direct relationship with the lender.

CrowdProperty stands out by offering a direct-to-market lending solution while also partnering with brokers. This flexibility ensures that whether you’re looking for a direct lender relationship or prefer to leverage your broker’s relationship, we can help solve the biggest pain points in property development finance – speed, certainty and expertise of finance.

CrowdProperty loves working with the best brokers who often have long-lasting relationships with their clients and bring high-quality projects to trusted finance partners. These projects are typically simpler to review and approve as there is expertise from both parties. It’s a speed, expertise, and certainty win for everyone. Or, as we like to say, property finance by property people.

Are you a small-to-medium-scale developer looking for funds for your next project? Get the finance you need at CrowdProperty, which offers property finance by property experts.